b&o tax seattle

Have a Seattle business license see the due dates for that here file a business license tax return. 32 rows Business occupation tax classifications Print.

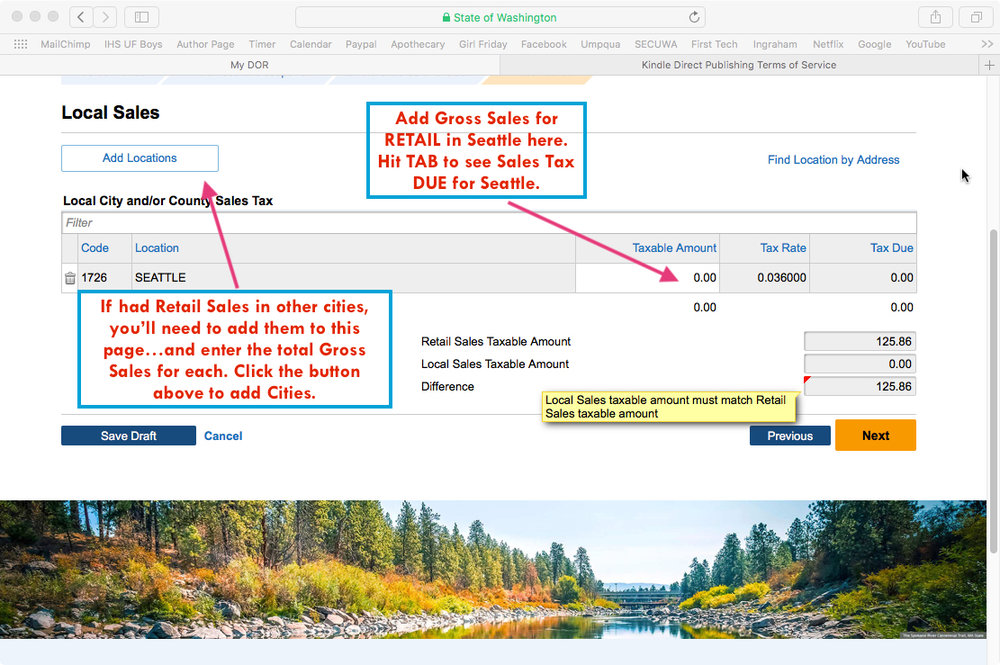

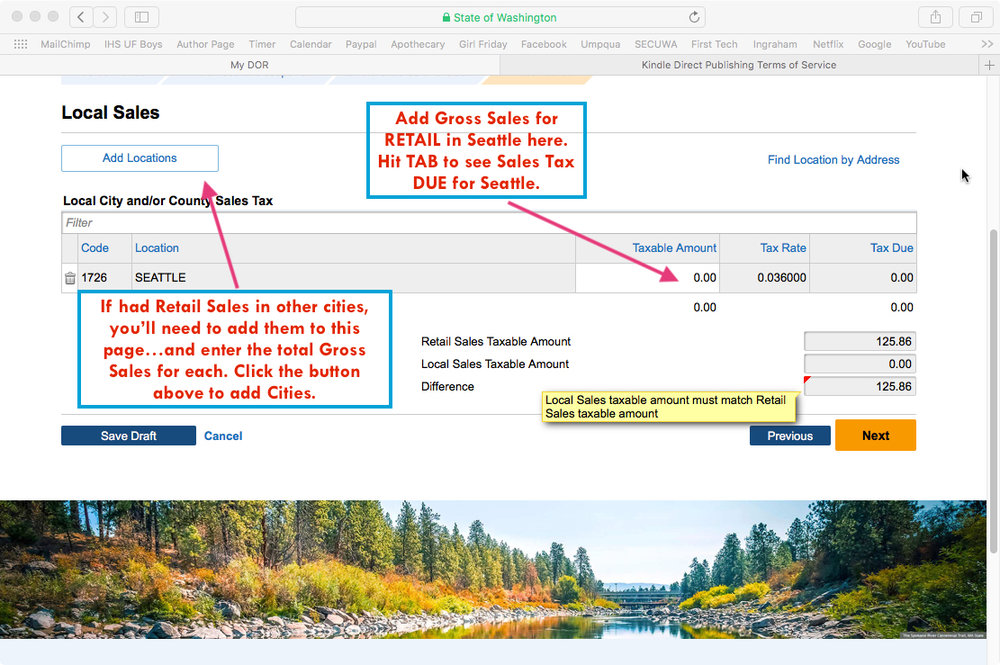

Pac Code Annual Report To Wa Dor Seattle Business Apothecary Resource Center For Self Employed Women

Though you dont owe tax it is a requirement to file your returns and report to Seattle BO even in the case of no activity.

. City of Seattle income tax apportionment provisions Seattles BO tax is generally imposed on all persons engaging in business activity within the city. PO Box 94728 Seattle WA 98124-4728 Phone. The BO is a tax on gross receipts.

It is measured on the value of products gross proceeds of sale or gross income of the business. Visit their website for a list of City BO Tax Rates pdf with applicable rates and contact phone numbers for. 600 4th Ave 3rd Floor Seattle WA 98104 Mailing Address.

Seattle Business and Occupation Taxes. CREATE BUSINESS ACCOUNT View the Taxpayer Quick Start Guide. The City of Bellevue collects certain taxes from businesses primarily the business and occupation B O tax which includes gross receipts and square footage taxes.

The current tax rates are 039 per square foot per quarter for business floor space and 013 per square foot per quarter for other floor space. Contact the city directly for specific information or other business licenses or taxes that may apply. You may also reach us via email recommended at taxseattlegov or by phone at 206 684-8484 from 8 am.

Have a local BO tax. BEFORE YOU GET STARTED. CPAs and accounting firms.

The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. If your business is a retail store and you are filing a local tax return for 2017 the tax rate you will pay is 000219 or 219. To 5 pm Monday-Friday excluding City holidays.

Create a business account to register your business file returns and pay local BO taxes. Nobody likes taxes but people really really hate the levy Washington imposes on businesses. Entities engaging in business inside the Seattle city limits are required to pay a business and occupation BO tax.

Business occupation tax classifications. However you may be entitled to the. V voter approved increase above statutory limit e rate higher than statutory limit because rate was effective prior to January 1 1982 ie grandfathered.

The Seattle permit to operate. It is sometimes called the Seattle business and occupation tax BO tax or gross receipts tax. Depending on your situation filing your Seattle taxes may be relatively simple or fairly complex.

Washingtons BO tax is calculated on the gross income from activities. Returns are not deemed filed until both tax filing and. The state BO tax is a gross receipts tax.

Specialized BO tax classifications. This table below summarizes Seattle business license tax rates and classifications. If your business is a professional services firm like a law or accounting firm and you are filing a local tax return for 2019 the tax rate you will pay is 000427 or 427.

Think the Apple Cup but with lots more money at stake. The square footage BO tax applies to businesses that maintain a business location within Seattle and conduct out-of-city business activities. You pay the tax if your annual taxable gross revenue is 100000 or more.

Called the Business Occupation Tax the BO is loathed with the intensity usually reserved for your college football teams archrival. This means there are no deductions from the BO tax for labor materials taxes or other costs of doing. Businesses Exempt from City BO Tax - BIMC 388 505090 508 states that the Citys BO Tax does not apply to certain business activities to which tax liability is imposed by other meansBusiness activities not subject to BO Tax are.

3 In 2006 KMS successfully defeated an effort by Seattle to impose a BO tax on KMS based on all commissions received in the KMS Seattle office regardless of where the registered representative generating the. Manual forms can be completed and mailed to the address provided on the back of the form. You do not owe general business and occupation BO tax if your annual turnover revenues were below 100000 in Seattle.

Our public counters on the 4th floor of the Seattle Municipal Tower 700 Fifth Ave are now open by appointment only Tuesdays and Wednesdays 830 am-4 pm. Athletic Exhibitions BIMC 505090Casual and Isolated Sales. The model was updated in 2007 2012 and 2019EHB 2005 passed in 2017 also established a task force of city and business representatives to recommend changes to the two-factor apportionment formula for service income under RCW.

Kenmores BO tax applies to heavy manufacturing only. This is the same portal many taxpayers currently use to file and pay a variety of other Seattle business taxes including BO Commercial Parking Admissions etc. Box 34214 Seattle WA 98124-4214.

Legislation adopted in the 2003 session required the 45 cities with local BO taxes to adopt a city BO tax model ordinance. License and tax administration 206 684-8484 taxseattlegov. The BO tax is calculated based on gross business receipts less allowable deductions and businesses fall into one of two rate categories.

If you need to file a 2021 annual tax return and have revenue that is below the 100000 threshold you can use this tax form. The Department of Revenue does not administer or collect local BO taxes. It is sometimes called the Seattle business and occupation tax BO tax or gross receipts tax.

Open Monday through Friday 8 am. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax. The tax amount is based on the value of the manufactured products or by-products.

This tax is in addition to the BO tax imposed by the state of Washington. FileLocal is the online tax filing portal for the City of Seattle. Extracting Extracting for Hire00484.

Washington unlike many other states does not have an income tax. Create a tax preparer account to file returns for multiple clients example. May 28 2021 By john.

Commercial Parking Business BIMC 510. Although there are exemptions every person firm association or corporation doing business in. Manufacturing Processing for Hire Extracting Printing Publishing Wholesaling and.

Service other activities015. The square footage BO tax is based on rentable square feet. If you do business in Seattle you must.

The Municipal Research and Services Center provides information about city BO taxes.

How To Form An Llc In Washington Llc Filing Wa Swyft Filings

Pac Code Annual Report To Wa Dor Seattle Business Apothecary Resource Center For Self Employed Women

Pac Code Annual Report To Wa Dor Seattle Business Apothecary Resource Center For Self Employed Women

In 2019 Washington State Enacts Major Tax Increases New Economic Nexus Threshold And Stringent Requirement For Nonresident Exemption Andersen

Pac Code Annual Report To Wa Dor Seattle Business Apothecary Resource Center For Self Employed Women

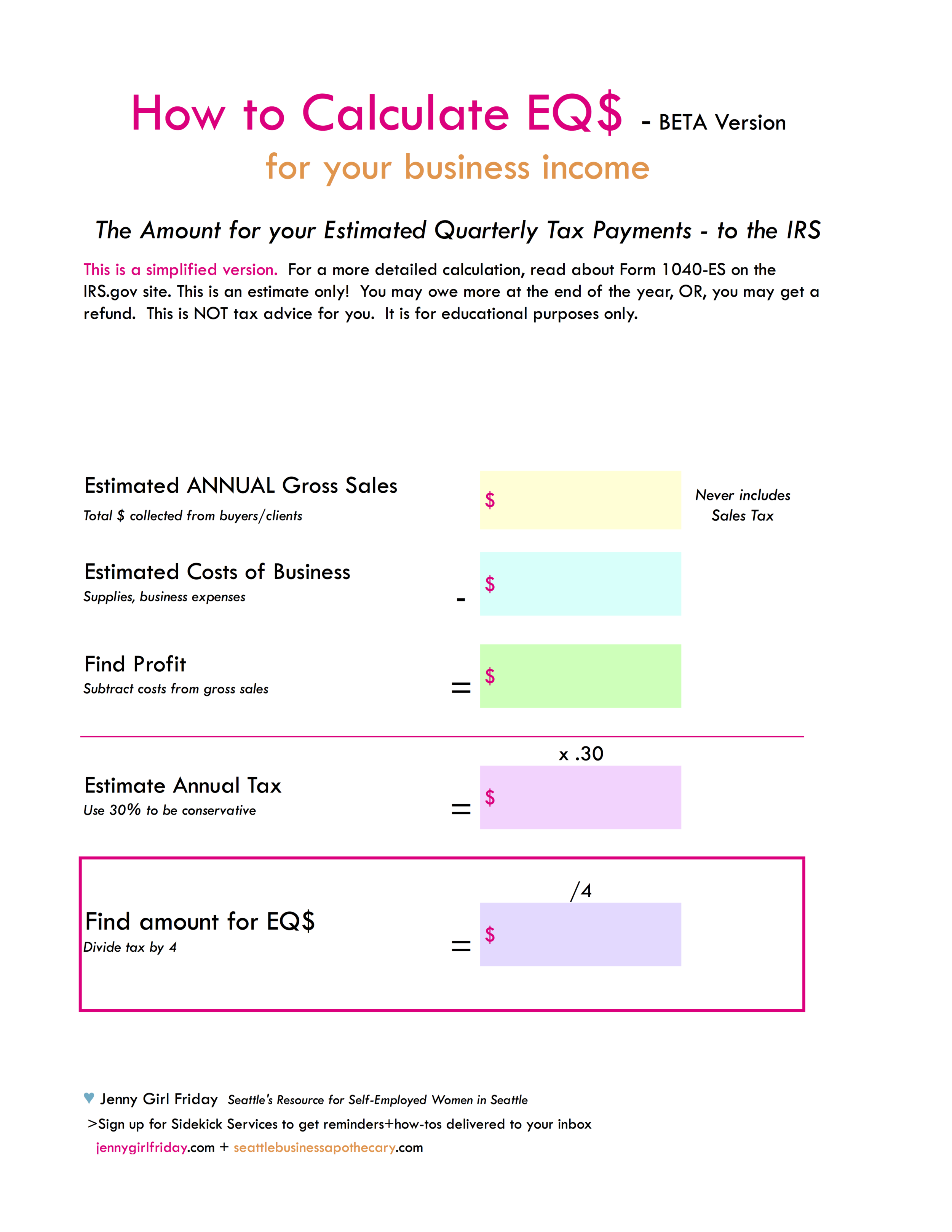

Eq Blog Seattle Business Apothecary Resource Center For Self Employed Women

Fill Free Fillable Forms City Of Everett

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

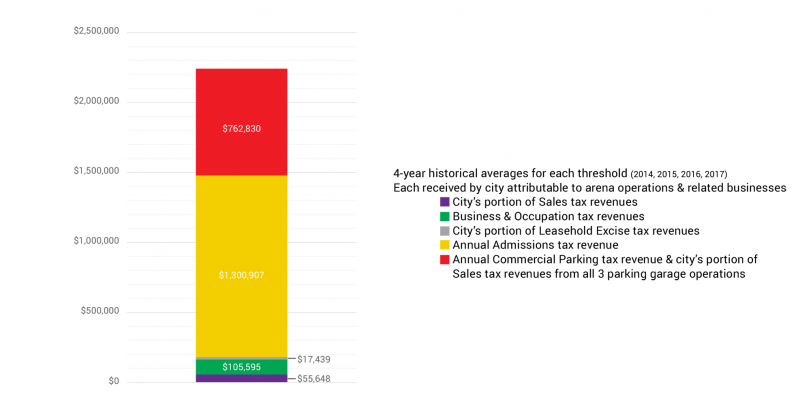

Understanding The Seattle Center Arena Agreement Cascadia Sports Network

Pac Code Annual Report To Wa Dor Seattle Business Apothecary Resource Center For Self Employed Women

City Of Mercer Island Business Licenses

Gov Inslee Signs Tax Bill To Help Fund Higher Education Redmond Reporter

Eq Blog Seattle Business Apothecary Resource Center For Self Employed Women

Is Food Taxable In Washington State Destinationpackwood Com

Eq Blog Seattle Business Apothecary Resource Center For Self Employed Women

Proposed State Tax On Sale Of Personal Data Faces A Fight From Business Groups Geekwire