unemployment tax refund check status

See How Long It Could Take Your 2021 Tax Refund. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next.

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

But between federal tax.

. Federal law requires employers to withhold taxes from an employees earnings to fund the Social Security and Medicare programs. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion. 24 hours after e-filing.

Check For The Latest Updates And Resources Throughout The Tax Season. Login to e-Filing website with User ID Password Date of Birth Date of Incorporation and Captcha. The unemployment tax refund is only for those filing individually.

By Anuradha Garg. The exact refund amount will depend on the persons overall income. Will display the status of your refund usually on the most recent tax year refund we have on file for you.

IRS unemployment refund update. If youre anticipating an unemployment tax refund your best bet is to track the status of it and see when it would arrive in your bank account. Your Social Security number or Individual Taxpayer Identification Number.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. Using the IRS Wheres My Refund tool. As an employer the City also pays a tax equal to the amount withheld from an employees earnings.

22 2022 Published 742 am. If you use e-file your refund should be issued between two and three weeks. This is available under View Tax Records then click the Get Transcript button and choose the.

These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt. Since may the irs has issued more than 87 million unemployment compensation tax. Another way is to check your tax transcript if you have an online account with the IRS.

Go to My Account and click on RefundDemand Status. If you received unemployment benefits in 2020 a tax refund may be on its way to you. UNEMPLOYMENT INSURANCE BENEFITS STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT You can receive your unemployment benefits two ways.

You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946. Check My Refund Status. Check the status of your refund through an online tax account.

Ad Learn How Long It Could Take Your 2021 Tax Refund. 4 weeks after you mailed your return. Reason For Refund Failure if any Mode of Payment is displayed.

If you chose to receive your refund through direct deposit you should receive it within a week. My unemployment actually went to my turbo card. These are called Federal Insurance Contributions Act FICA taxes.

Unemployment tax refund status. Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund. How to track and check its state The tax authority is in the process of sending out tax rebates to over 10 million Americans who incorrectly paid.

Viewing your IRS account information. The IRS should issue your refund check within six to eight weeks of filing a paper return. Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. Below details would be displayed.

This is the fourth round of refunds related to the unemployment compensation exclusion provision. To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer.

The IRS has cautioned that the refund is is subject to normal offset rules the IRS said meaning that it can be used to cover past-due federal tax state income tax state unemployment. Online Account allows you to securely access more information about your individual account. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online.

Direct Deposit into a bank account of your choice or via a Bank of America debit card If you choose the debit card method you may use them at any. View Refund Demand Status. You can check on the status of your refund by clicking on the links below.

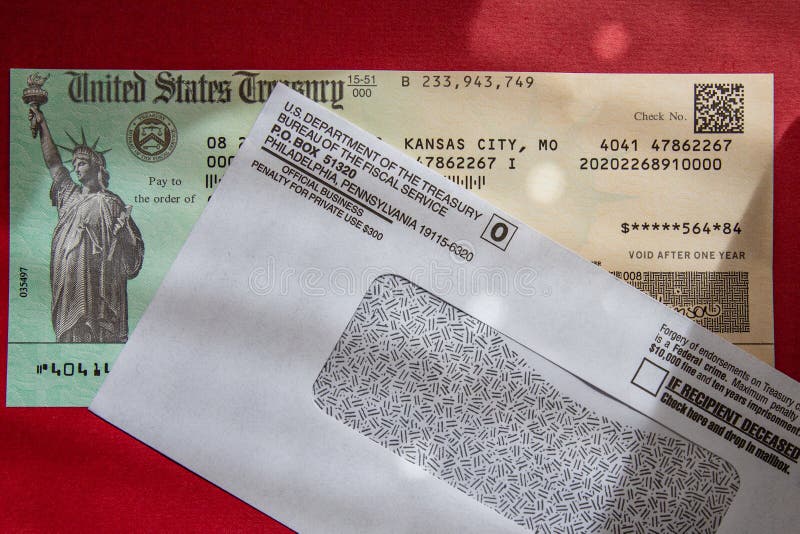

Unemployment Refund Tracker Unemployment Insurance TaxUni. Participants complete Individual Income Tax Return 1040 Forms using the fraudulently obtained information falsifying wages earned taxes withheld and other data and always ensuring the fraudulent form generates a tax refund check from the US. TAX SEASON 2021.

This is the latest round of refunds related to the added tax exemption for the first 10200 of. The 10200 is the amount of income exclusion for single filers not the amount of the refund.

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Sends Out 1 5 Million Surprise Tax Refunds

How To Find Your Irs Tax Refund Status H R Block Newsroom

You Have One Last Chance To Get A Surprise Tax Refund This Year The Irs Says

So There S No Fourth Stimulus Check But You Can Still Get A Child Tax Credit Wkrc

2 8 Million People Are Getting Irs Refunds This Week 10 Million More May Get Money Too Wbff

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 Chicago

6 745 Irs Refund Photos Free Royalty Free Stock Photos From Dreamstime

Irs Unemployment Tax Refunds 4 Million More Going Out This Week King5 Com